Current Research

The Impact of Mobility Grants on Researchers with Stefano Baruffaldi and Yevgeniya Shevtsova

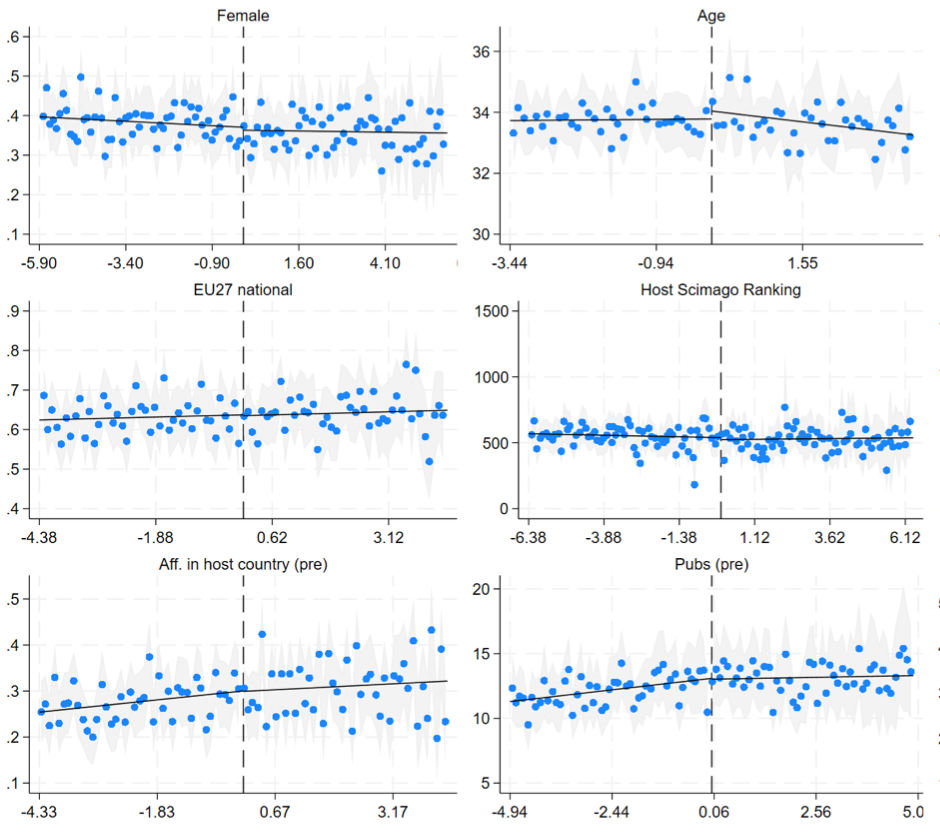

The international mobility of researchers has been central to the policy-makers' agendas for several decades. Despite the growing presence of mobility grants within public funding agencies' portfolios, empirical evidence on their effects remains scant. In this paper, we contribute to the literature by studying the Marie Skłodowska-Curie Individual Fellowships, the flagship program of the EU, providing competitive grants to researchers to spend a research period abroad. Based on data for the universe of applicants to the Seventh Framework Programme (2007-2013), we exploit the discontinuity in grant assignment to uncover causal effects on individual researchers. Results show that Individual Fellowships are indeed conducive to higher chances of experiencing mobility to the scientists' country of choice. Additionally, we show that grants supporting extra-European mobility, as opposed to those supporting mobility within Europe, lead to an increase in terms of publication quantity and quality, and help researchers expand their collaboration networks. This suggests that grants are most effective when targeting mobility flows subject to larger frictions.

The international mobility of researchers has been central to the policy-makers' agendas for several decades. Despite the growing presence of mobility grants within public funding agencies' portfolios, empirical evidence on their effects remains scant. In this paper, we contribute to the literature by studying the Marie Skłodowska-Curie Individual Fellowships, the flagship program of the EU, providing competitive grants to researchers to spend a research period abroad. Based on data for the universe of applicants to the Seventh Framework Programme (2007-2013), we exploit the discontinuity in grant assignment to uncover causal effects on individual researchers. Results show that Individual Fellowships are indeed conducive to higher chances of experiencing mobility to the scientists' country of choice. Additionally, we show that grants supporting extra-European mobility, as opposed to those supporting mobility within Europe, lead to an increase in terms of publication quantity and quality, and help researchers expand their collaboration networks. This suggests that grants are most effective when targeting mobility flows subject to larger frictions.R&D Grants and the Novelty of Innovation with Martina Iori and Andrea Mina

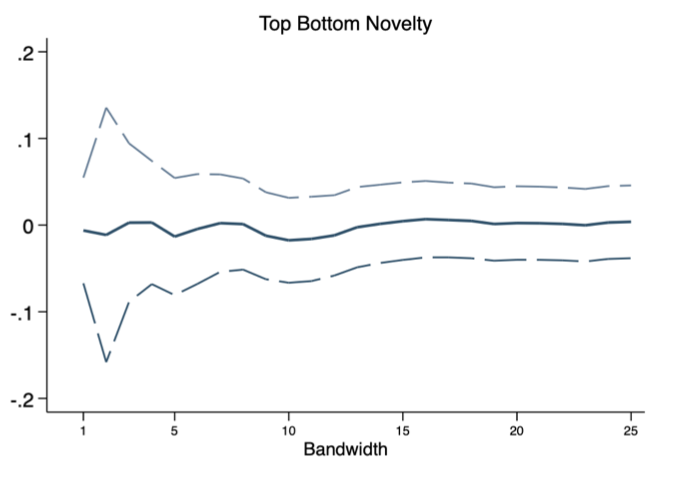

The paper examines whether competitive R&D grants incentivize private firms to pursue innovation in unexplored directions or more conventional ones. We use applicant-level data from the largest European program awarding R&D grants to individual small and medium-sized enterprises. We find that having unconventional patents before the program or submitting an atypical proposal does not affect ranking or the likelihood of winning, thus yielding no evidence of systematic bias against novelty in grant allocation. We then exploit the discontinuity in the program design to infer the effects of grants and find that: i) they induce firms to innovate in domains that are new and distant from their past technological trajectories; ii) they increase the likelihood of introducing unconventional patents without increasing the chances of filing conventional ones. These results are driven by firms that are cash-constrained, which is consistent with the idea that financial frictions hinder more risky and experimental research endeavors.

The paper examines whether competitive R&D grants incentivize private firms to pursue innovation in unexplored directions or more conventional ones. We use applicant-level data from the largest European program awarding R&D grants to individual small and medium-sized enterprises. We find that having unconventional patents before the program or submitting an atypical proposal does not affect ranking or the likelihood of winning, thus yielding no evidence of systematic bias against novelty in grant allocation. We then exploit the discontinuity in the program design to infer the effects of grants and find that: i) they induce firms to innovate in domains that are new and distant from their past technological trajectories; ii) they increase the likelihood of introducing unconventional patents without increasing the chances of filing conventional ones. These results are driven by firms that are cash-constrained, which is consistent with the idea that financial frictions hinder more risky and experimental research endeavors.Some Causal Effects of a Place-Based Innovation Policy with Francesco Manaresi and Emanuele Russo

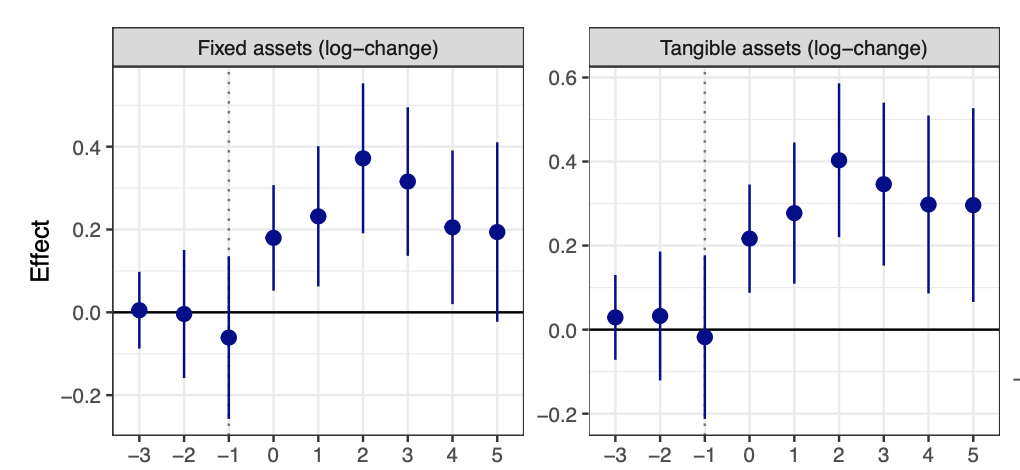

This study leverages randomization in priority rankings for subsidy assignment to gauge the causal effects of a place-based policy in Liguria, Italy. The program, based on the Smart Specialization Strategy framework, was designed to support innovation through financial incentives for local firms. The analysis documents that the policy spurred significant increases in both tangible and intangible assets, along with an increase in patenting activity on the extensive margin. The subsidies also led to higher firm revenues, employment, and survival rates, but did not result in productivity gains. We find that the policy was particularly beneficial for smaller and younger firms, while interaction with other subsidies indicated substitution effects rather than complementarities, suggesting a need for careful design of subsidy programs to avoid overlapping incentives.

This study leverages randomization in priority rankings for subsidy assignment to gauge the causal effects of a place-based policy in Liguria, Italy. The program, based on the Smart Specialization Strategy framework, was designed to support innovation through financial incentives for local firms. The analysis documents that the policy spurred significant increases in both tangible and intangible assets, along with an increase in patenting activity on the extensive margin. The subsidies also led to higher firm revenues, employment, and survival rates, but did not result in productivity gains. We find that the policy was particularly beneficial for smaller and younger firms, while interaction with other subsidies indicated substitution effects rather than complementarities, suggesting a need for careful design of subsidy programs to avoid overlapping incentives.