Peer-Reviewed articles

Regional Incidence and Persistence of High-Growth Firms with Alex Coad, Clemens Domnick, Stjepan Srhoj Regional Studies forthcoming

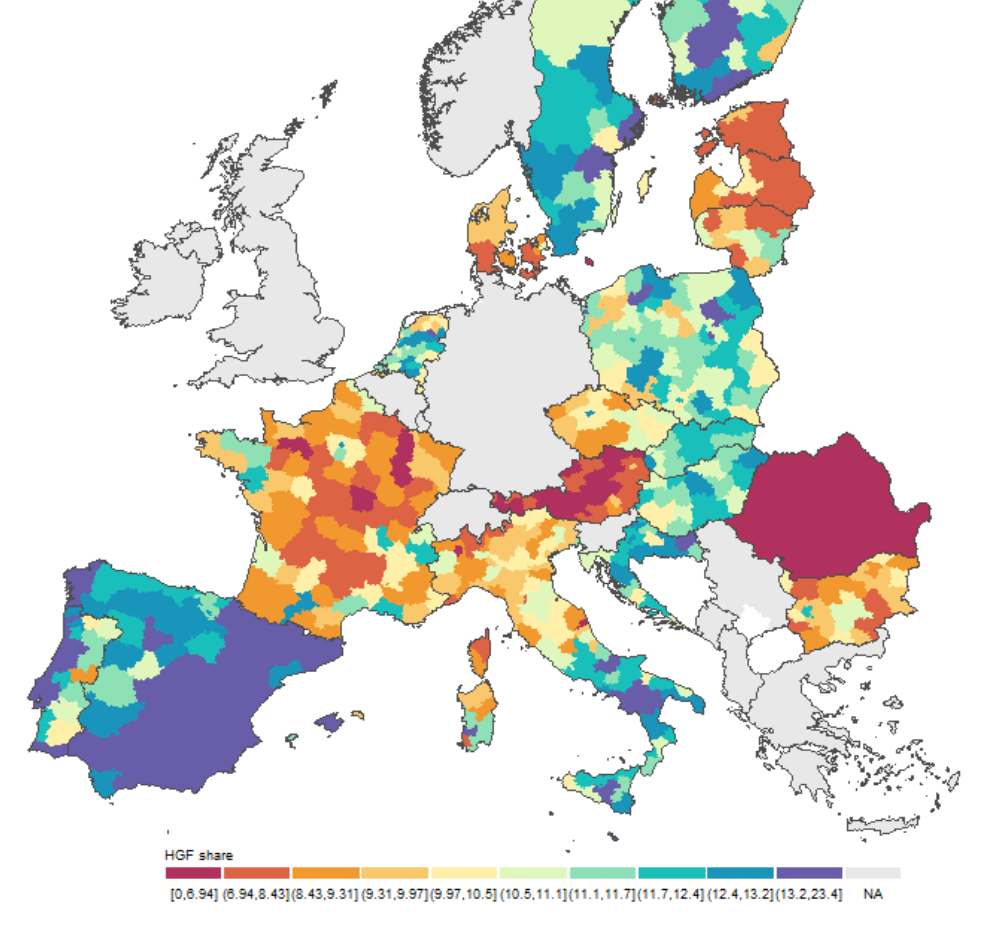

Policy-makers and scholars often assume that a higher incidence of high-growth firms (HGFs) is synonymous with vibrant regional economic dynamics, and that HGF shares are persistent over time as Entrepreneurial Ecosystems (EEs) have slowly-changing features. In this paper we test these hypotheses, which are deeply rooted in the EE literature. We draw upon Eurostat data for up to 20 countries over the period 2008-2020 and study HGF shares in NUTS-3 regions in Europe. Analysis of regional rankings yields the puzzling finding that the leading EEs in Europe, apparently, are in places such as southern Spain and southern Italy. These places would not normally be considered Europe’s foremost entrepreneurial hotspots. Additional results do not provide strong support for the hypothesis that more developed regions feature higher HGF shares. We do find evidence consistent with HGF shares displaying persistency over time. However, we show that more developed regions do not have higher persistence in their HGF shares, and that the strength in persistence does not increase across the HGFs distribution, which does not support path-dependency as the main mechanism behind the observed persistence. Overall, we call for a more nuanced interpretation of both regional HGF shares and the EEs literature.

Policy-makers and scholars often assume that a higher incidence of high-growth firms (HGFs) is synonymous with vibrant regional economic dynamics, and that HGF shares are persistent over time as Entrepreneurial Ecosystems (EEs) have slowly-changing features. In this paper we test these hypotheses, which are deeply rooted in the EE literature. We draw upon Eurostat data for up to 20 countries over the period 2008-2020 and study HGF shares in NUTS-3 regions in Europe. Analysis of regional rankings yields the puzzling finding that the leading EEs in Europe, apparently, are in places such as southern Spain and southern Italy. These places would not normally be considered Europe’s foremost entrepreneurial hotspots. Additional results do not provide strong support for the hypothesis that more developed regions feature higher HGF shares. We do find evidence consistent with HGF shares displaying persistency over time. However, we show that more developed regions do not have higher persistence in their HGF shares, and that the strength in persistence does not increase across the HGFs distribution, which does not support path-dependency as the main mechanism behind the observed persistence. Overall, we call for a more nuanced interpretation of both regional HGF shares and the EEs literature.Spurring Subsidy Entrepreneurs with Emanuele Russo Research Policy (2025)

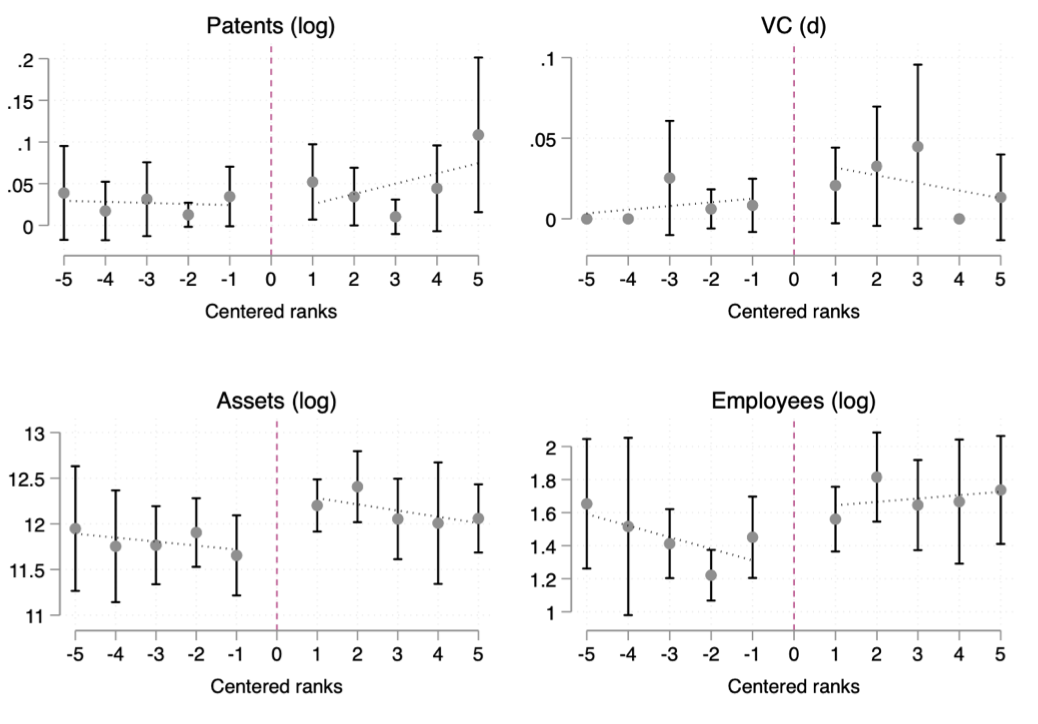

In the attempt to boost innovation, policy-makers have enacted a myriad of programs targeting innovative start-ups in recent years. Empirical evidence on these initiatives has almost exclusively focused on national-level programs, overlooking those implemented at the local level. This paper provides the first quasi-experimental evidence on the joint effects of local policies focusing on Italy, where regional governments have been very active in providing financial support to these firms. By leveraging discontinuities in program design, we adopt a local randomization approach and document a null effect of these programs over a wide range of firm-level outcomes. However, we find that securing local subsidies increases start-ups’ probability to obtain additional public subsidies, which points in the direction of a vicious “Matthew effect” in subsidy allocation. Consistent with both reputation and learning mechanisms, the increase in follow-on subsidies occurs for funds disbursed at the local level only, whereas no effect is detected for subsidies allocated by national or international authorities.

In the attempt to boost innovation, policy-makers have enacted a myriad of programs targeting innovative start-ups in recent years. Empirical evidence on these initiatives has almost exclusively focused on national-level programs, overlooking those implemented at the local level. This paper provides the first quasi-experimental evidence on the joint effects of local policies focusing on Italy, where regional governments have been very active in providing financial support to these firms. By leveraging discontinuities in program design, we adopt a local randomization approach and document a null effect of these programs over a wide range of firm-level outcomes. However, we find that securing local subsidies increases start-ups’ probability to obtain additional public subsidies, which points in the direction of a vicious “Matthew effect” in subsidy allocation. Consistent with both reputation and learning mechanisms, the increase in follow-on subsidies occurs for funds disbursed at the local level only, whereas no effect is detected for subsidies allocated by national or international authorities.The Causal Effects of R&D Grants: Evidence from a Regression Discontinuity

with Andrea Mina, Irene Martelli, and Alberto Di Minin The Review of Economics and Statistics (2022)

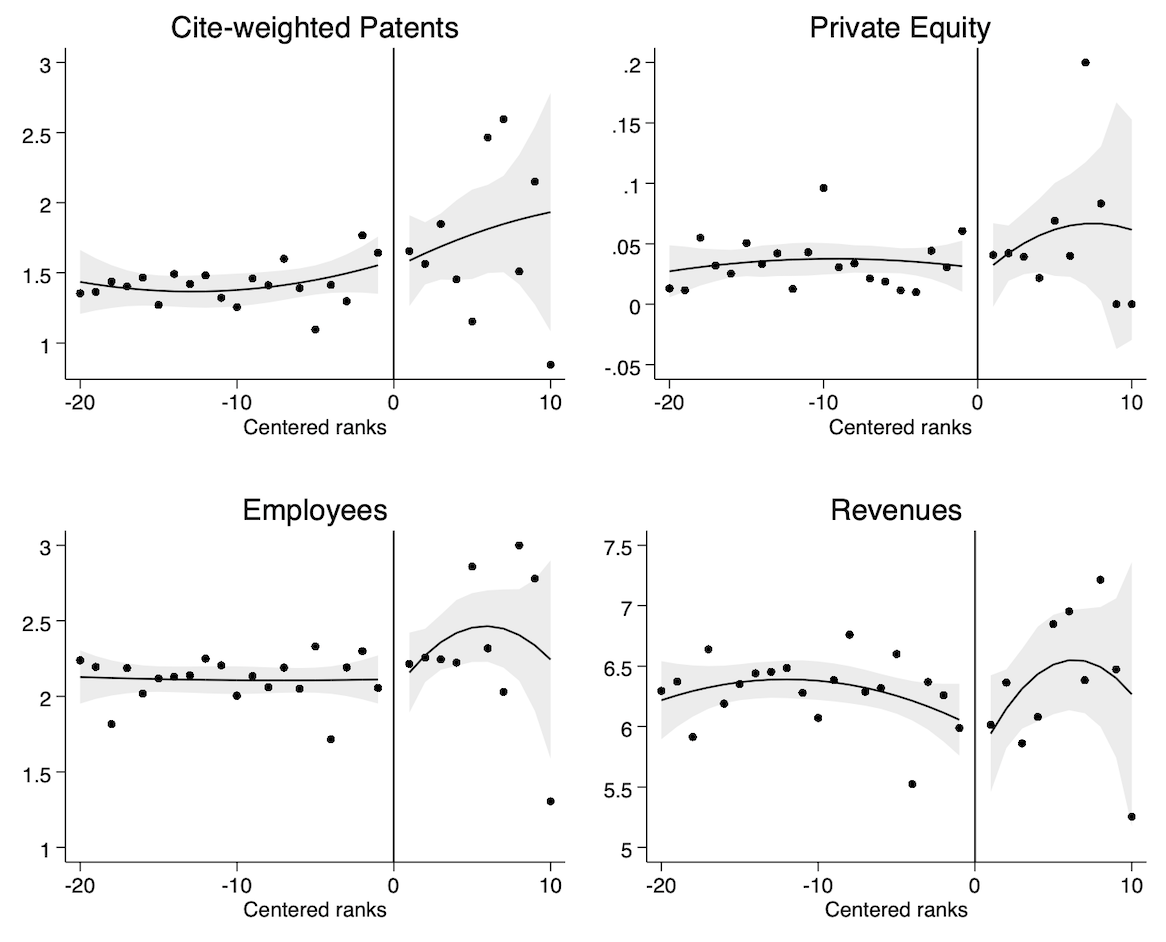

We leverage the discontinuity in the assignment mechanism of the Small and Medium Enterprise Instrument - the first European R&D subsidy targeting small firms - to provide the broadest quasi-experimental evidence on R&D grants over both geographical and sectoral scopes. Grants trigger sizable impacts on a wide range of firm-level outcomes. Heterogeneous effects are consistent with grants reducing financial frictions. This reduction is due to funding rather than certification. We also provide direct causal evidence on pure certification - signaling not attached to funding - and show that firms that only receive ‘quality stamps’ do not improve their performance. Finally, our estimates suggest that the scheme produces private returns that are positive and comparable to those of the US Small Business Innovation Research program, while also generating geographical and sectoral spillovers in the form of increased rates of entrepreneurial entry.

We leverage the discontinuity in the assignment mechanism of the Small and Medium Enterprise Instrument - the first European R&D subsidy targeting small firms - to provide the broadest quasi-experimental evidence on R&D grants over both geographical and sectoral scopes. Grants trigger sizable impacts on a wide range of firm-level outcomes. Heterogeneous effects are consistent with grants reducing financial frictions. This reduction is due to funding rather than certification. We also provide direct causal evidence on pure certification - signaling not attached to funding - and show that firms that only receive ‘quality stamps’ do not improve their performance. Finally, our estimates suggest that the scheme produces private returns that are positive and comparable to those of the US Small Business Innovation Research program, while also generating geographical and sectoral spillovers in the form of increased rates of entrepreneurial entry.Featured in: New Things Under the Sun - VoxEu - LaVoce - IlSole24Ore. The work was presented at the NBER Summer Institute (slides here).

Supporting Innovative Entrepreneurship: An Evaluation of the Italian Start-up Act

with Francesco Manaresi and Carlo Menon Industrial and Corporate Change (2021)

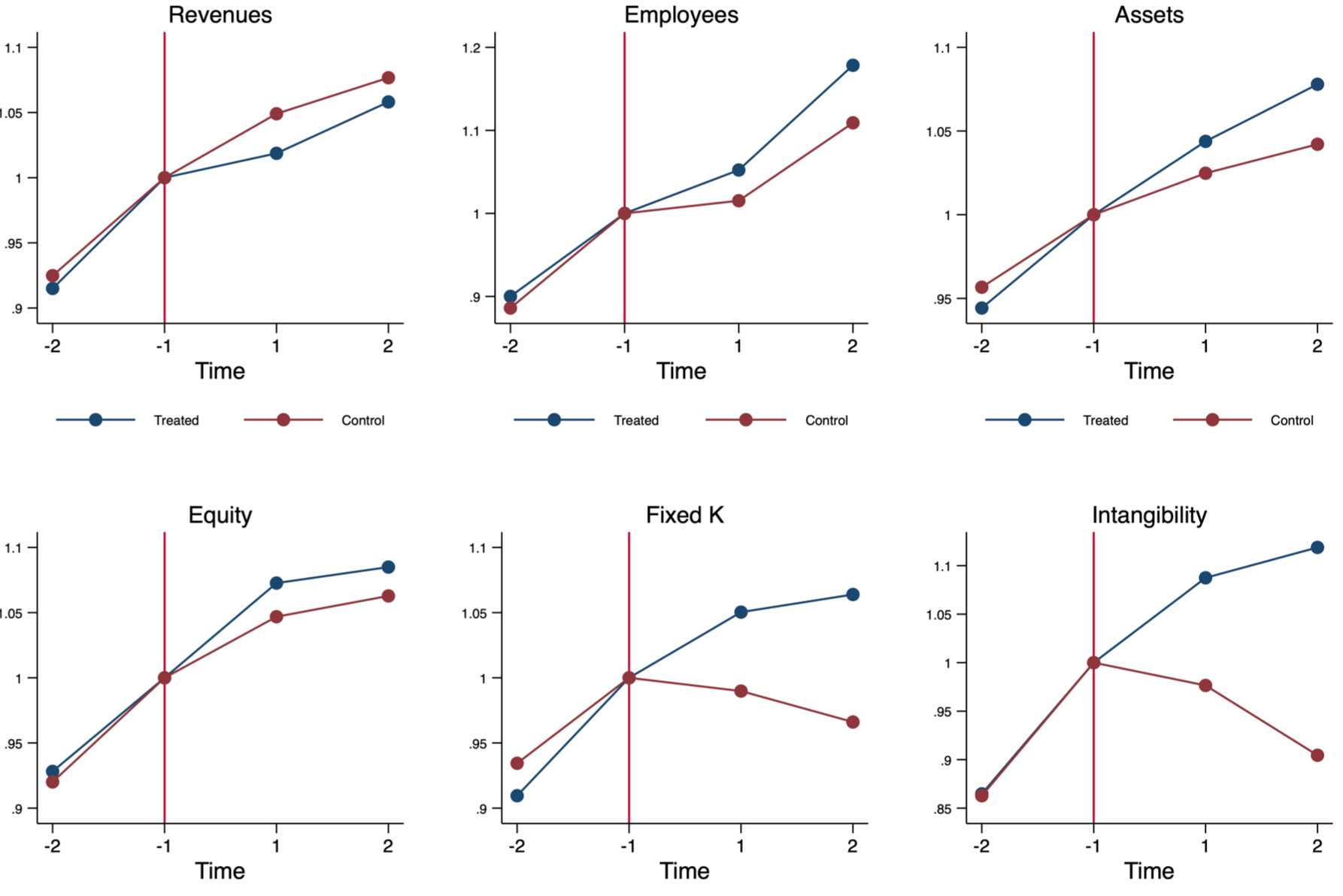

The role of innovative start-ups in contributing to aggregate economic dynamism has attracted increased attention in recent years. While this has translated into several public policies explicitly targeting them, there is little evidence on their effectiveness. This article provides a comprehensive evaluation of the “Start-up Act,” a policy intervention aimed at supporting innovative start-ups in Italy. We construct a unique database encompassing detailed information on firm balance sheets, employment, firm demographics, patents and bank–firm relationships for all Italian start-ups. We use conditional difference-in-differences and instrumental variable strategies to evaluate the impact of the “Start-up Act” on firm performance. Results show that the policy induces a significant increase in several firm outcomes whereas no effect is detected in patenting propensity and survival chances. We also document that the policy alleviates financial frictions characterizing innovative start-ups through the provision of tax credits for equity and a public guarantee scheme which, respectively, trigger an increase in the probability of receiving VC and accessing bank credit.

The role of innovative start-ups in contributing to aggregate economic dynamism has attracted increased attention in recent years. While this has translated into several public policies explicitly targeting them, there is little evidence on their effectiveness. This article provides a comprehensive evaluation of the “Start-up Act,” a policy intervention aimed at supporting innovative start-ups in Italy. We construct a unique database encompassing detailed information on firm balance sheets, employment, firm demographics, patents and bank–firm relationships for all Italian start-ups. We use conditional difference-in-differences and instrumental variable strategies to evaluate the impact of the “Start-up Act” on firm performance. Results show that the policy induces a significant increase in several firm outcomes whereas no effect is detected in patenting propensity and survival chances. We also document that the policy alleviates financial frictions characterizing innovative start-ups through the provision of tax credits for equity and a public guarantee scheme which, respectively, trigger an increase in the probability of receiving VC and accessing bank credit.Public Funding of Innovation: Exploring Applications and Allocations of the European SME Instrument

with Andrea Mina, Irene Martelli, Alberto Di Minin and Giuseppina Testa Research Policy (2021)

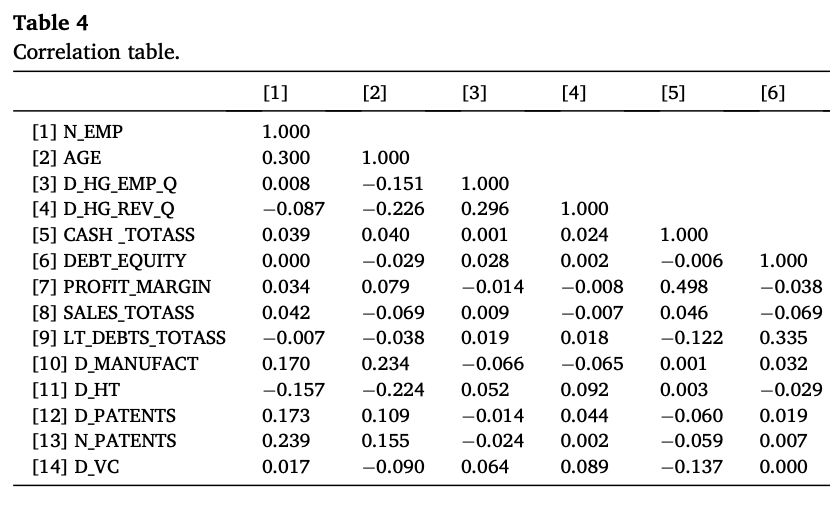

Financial constraints can severely limit the development of small and medium size enterprises (SMEs) and are very likely to affect innovative firms. In order to lower the barriers to firm growth, in 2014 the European Commission introduced the SME Instrument with the specific aim to support businesses with high-growth potential in need of external finance. By exploiting the availability of information not only on grant awards but also on applications, this is the first study that examines which types of firms apply to the scheme and which ones are selected for the two main rounds of funding. The evidence suggests that the scheme is successful at attracting SMEs with high-growth potential, and that – in line with signalling theory – patenting and prior venture capital funding are strong predictors of awards.

Financial constraints can severely limit the development of small and medium size enterprises (SMEs) and are very likely to affect innovative firms. In order to lower the barriers to firm growth, in 2014 the European Commission introduced the SME Instrument with the specific aim to support businesses with high-growth potential in need of external finance. By exploiting the availability of information not only on grant awards but also on applications, this is the first study that examines which types of firms apply to the scheme and which ones are selected for the two main rounds of funding. The evidence suggests that the scheme is successful at attracting SMEs with high-growth potential, and that – in line with signalling theory – patenting and prior venture capital funding are strong predictors of awards.The Effect of the Great Recession on the Employment Growth of Young vs. Small Firms in the Eurozone

with Andrea Mina Structural Change and Economic Dynamics (2021)

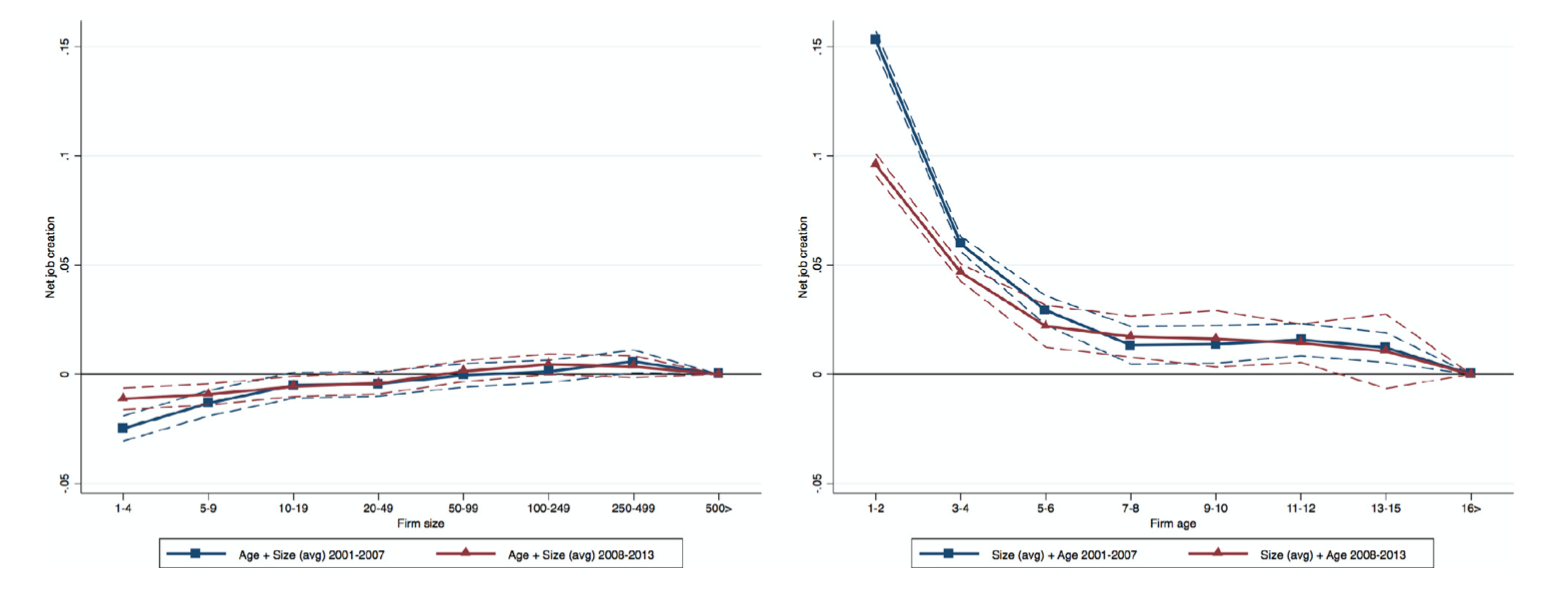

This paper examines the uneven impact of the Great Recession on firm-level employment growth across firm size and age classes. Based on firm-level data from ten Eurozone countries, we show that, notwithstanding the negative impact of the crisis, young firms were the most dynamic group of firms and prime contributors to net job creation even during the recession. However, conditional on survival, young firms experienced a sharp drop in their employment growth rates, whereas small firms were mostly unaffected. By using industry-level measures of external financial dependence, we then show how financial frictions were a driver of the growth rates slowdown of young firms.

This paper examines the uneven impact of the Great Recession on firm-level employment growth across firm size and age classes. Based on firm-level data from ten Eurozone countries, we show that, notwithstanding the negative impact of the crisis, young firms were the most dynamic group of firms and prime contributors to net job creation even during the recession. However, conditional on survival, young firms experienced a sharp drop in their employment growth rates, whereas small firms were mostly unaffected. By using industry-level measures of external financial dependence, we then show how financial frictions were a driver of the growth rates slowdown of young firms.Innovation and Job Creation in (High-growth) New Firms

Industrial and Corporate Change (2020)

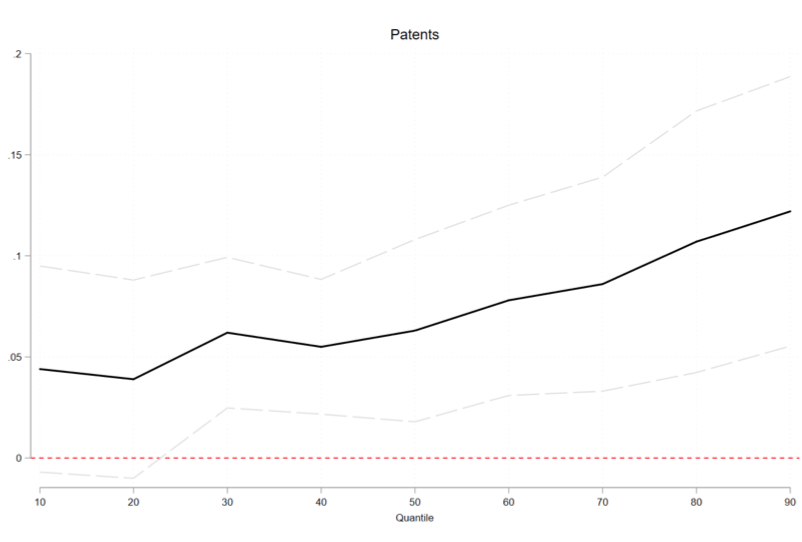

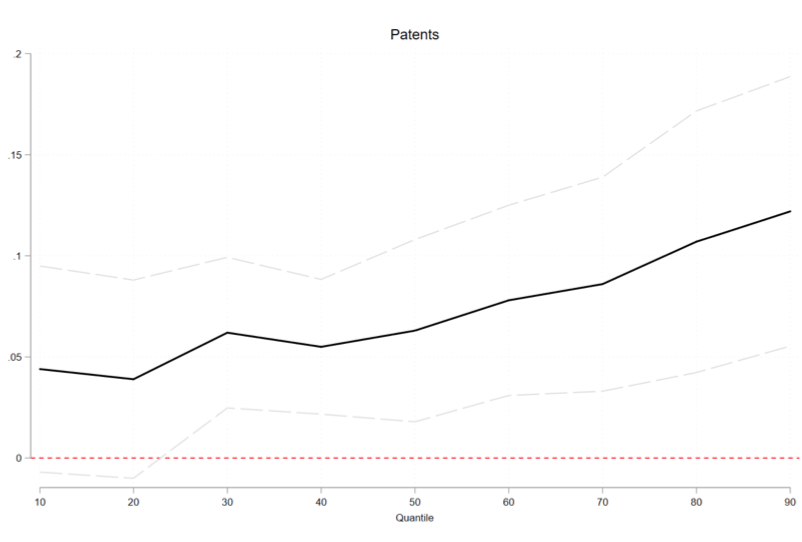

Recent research has underscored the prominent role played by a small fraction of fast-growing new firms in contributing to aggregate net employment growth. While it is typically assumed that those firms experience this superior performance thanks to their ability in undertaking technological innovation, few empirical studies have explicitly addressed this issue. This article examines the innovation-employment nexus for startups using the Kauffman Firm Survey, a unique longitudinal dataset tracking a single cohort of US firms founded in 2004. Results based on fixed effects panel quantile regressions indicate an overall positive but heterogeneous effect of innovation activities on the conditional employment growth distribution. More in detail, the findings reveal that both research and development and patents have a positive association with employment growth especially for those new firms experiencing high growth.

Recent research has underscored the prominent role played by a small fraction of fast-growing new firms in contributing to aggregate net employment growth. While it is typically assumed that those firms experience this superior performance thanks to their ability in undertaking technological innovation, few empirical studies have explicitly addressed this issue. This article examines the innovation-employment nexus for startups using the Kauffman Firm Survey, a unique longitudinal dataset tracking a single cohort of US firms founded in 2004. Results based on fixed effects panel quantile regressions indicate an overall positive but heterogeneous effect of innovation activities on the conditional employment growth distribution. More in detail, the findings reveal that both research and development and patents have a positive association with employment growth especially for those new firms experiencing high growth.Exploring the Link Between Innovation and Firm Growth in Chilean Firms

with Caterina Santi Small Business Economics (2017)

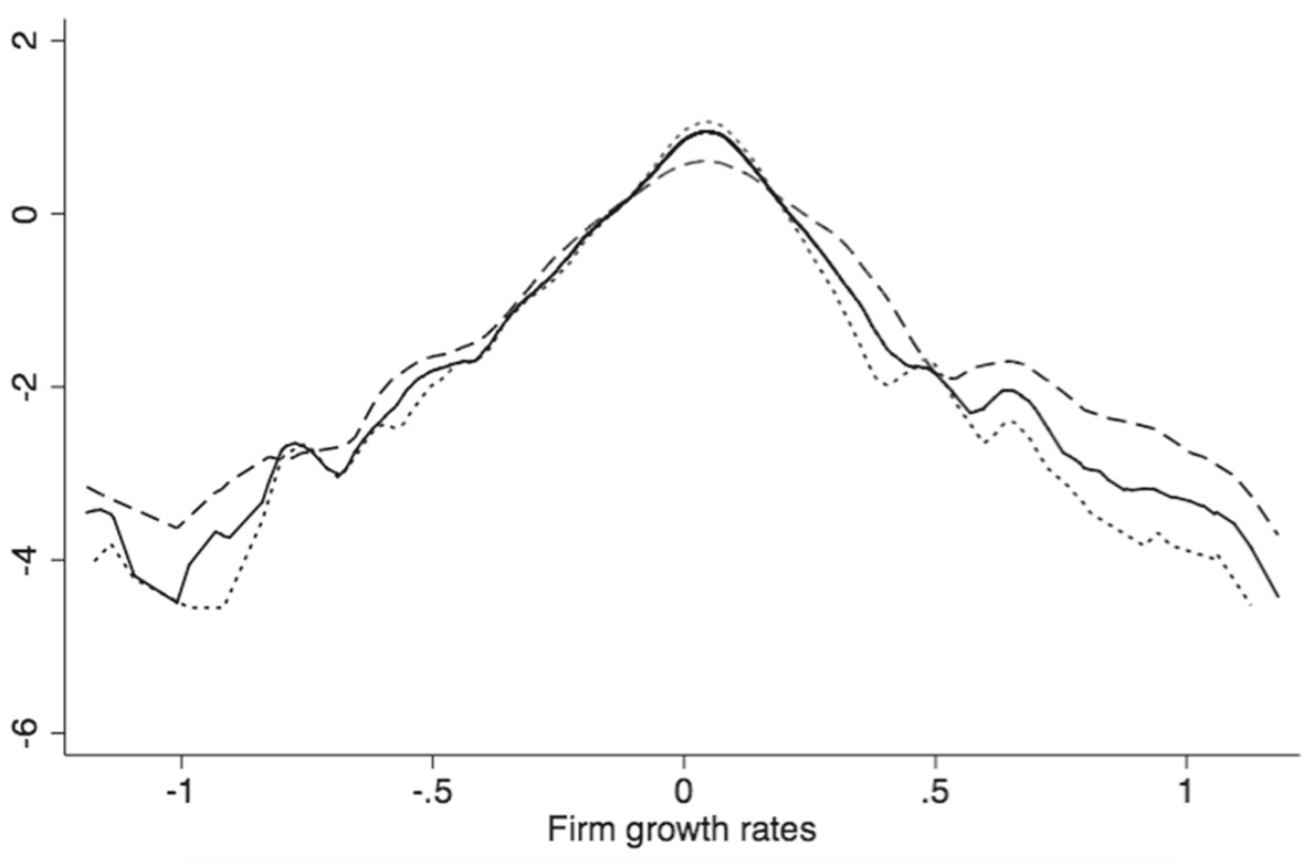

We investigate the relation between the introduction of innovation and subsequent firm growth employing a dataset representative of the Chilean productive structure. By means of quantile treatment effects (QTE), we estimate the effect of the introduction of innovation by comparing firms with a similar propensity to innovate for different quantiles of the firm growth distribution. Our results indicate that process innovation positively affects sales growth for those firms located at the 75th and 90th percentiles. Contrarily, product innovation appears not to be a driver of firm performance. We also find that process innovation benefits mature firms at higher quantiles while it positively affects young firms located at low-medium quantiles.

We investigate the relation between the introduction of innovation and subsequent firm growth employing a dataset representative of the Chilean productive structure. By means of quantile treatment effects (QTE), we estimate the effect of the introduction of innovation by comparing firms with a similar propensity to innovate for different quantiles of the firm growth distribution. Our results indicate that process innovation positively affects sales growth for those firms located at the 75th and 90th percentiles. Contrarily, product innovation appears not to be a driver of firm performance. We also find that process innovation benefits mature firms at higher quantiles while it positively affects young firms located at low-medium quantiles.Diversity and Intensity of ICTs Use and Product Innovation: Evidence from Chilean Micro-data

Economics of Innovation and New Technology (2015)

This study uses data from two waves of the Encuesta Longitudinal de Empresas (ELE) to examine the relationship between information and communication technologies (ICT) use and product innovation in Chilean firms. Our findings sustain the hypothesis that ICT act as enablers of innovation. However, the impacts of ICT on product innovation depend on the type of application considered. In particular, we find positive and significant association between production-integrating ICT, i.e. administrative and industry-specific software, and product innovation, while this is not the case for market-oriented ICT such as e-commerce or client relationship manager software. Finally, the results show that not every ICT combination is beneficial for innovation: firms that show a basic use of ICT are not associated with a better likelihood of introducing innovation, while firms with an advanced use of ICT are those with the more likelihood of innovating.

This study uses data from two waves of the Encuesta Longitudinal de Empresas (ELE) to examine the relationship between information and communication technologies (ICT) use and product innovation in Chilean firms. Our findings sustain the hypothesis that ICT act as enablers of innovation. However, the impacts of ICT on product innovation depend on the type of application considered. In particular, we find positive and significant association between production-integrating ICT, i.e. administrative and industry-specific software, and product innovation, while this is not the case for market-oriented ICT such as e-commerce or client relationship manager software. Finally, the results show that not every ICT combination is beneficial for innovation: firms that show a basic use of ICT are not associated with a better likelihood of introducing innovation, while firms with an advanced use of ICT are those with the more likelihood of innovating.Working papers

The Evaluation of the Italian Start-up Act

with Timothy DeStefano, Francesco Manaresi, Carlo Menon and Giovanni Soggia OECD Science, Technology and Industry Policy Papers (2018)

Featured in: LaVoce - IlSole24Ore. The work was presented at the Italian Parliament (watch video in Italian here).

Growth and Survival of the Fitter? Evidence from US New Born Firms

with Giovanni Dosi and Emanuele Pugliese LEM Working Paper Series (2017)

Book chapters

with Giovanni Stumpo and Sebastian Rovira In Stumpo, G. and Rovira, S. Entre mitos y realidades. TIC, politicas publicas y desarrollo productivo en America Latina. ECLAC, Santiago de Chile